CORE Interactive Presentation

Interactive Experience and Downloadable PDF

the meeting customer newneeds in today’s experience economy payment experience

Welcome to the experience economy Where customer expectations and demands focus on the actual experience of everyday interactions. While the experience economy has technically been around for over two decades, the focus on convenience, personalization, and speed has accelerated in recent years. Consumers are spending more time than ever before on their mobile devices (nearly four hours every day), assessing every interaction with every business or brand, deciding whether or not it lives up to their interactive, simple, and ease-of-use criteria. They attach this new baseline to every area of consumption—dining out, retail, healthcare, education, fitness, and more. And the data backs up these trends. 80% of consumers cite speed and convenience as top priorities. Personalization impacts consumer purchasing decisions for 80% of consumers. And if an experience isn’t positive? Nearly 60% of consumers won’t recommend a business to a friend or family member. Trends in billing and payment are no different. CONTINUE

Contents 01 – Introduction 02 – The Experience Economy and Revenue Cycle Management 03 – A Connected Experience 04 – A Mobile Experience 05 – A Convenient Experience FRICTIONLESS | CONNECTED | ENGAGEMENT A PAYMENTANDREVENUESOLUTIONSCOMPANY | COREBT.COM | 1.866.567.CORE(2673)

Theexperience economyandrevenue cycle management The experience economy, and the expectations assumed by nearly all consumers, impacts the most important aspect of any buyer journey— checkout and payment.

This is a modal window.

For consumers, this shows up in multiple ways. Contactless payments create a simple, easy experience at checkout. And for mobile users, it’s becoming a standard at checkout. Over 60% of consumers report that they would switch to a new business that offered a contactless payment option in order to use it. 70% of businesses agree that consumers want the option for tap-and-go or mobile payment. Experience-based checkout isn’t simply a passing trend. 74% of consumers say they will continue to use contactless payment options, even after the pandemic is over.

Traditional, paper-based invoices and cashier or front deskcheckout experiences won’tlast... Traditional, paper-based invoices and cashier or front desk checkout experiences won’t last in this digital transformation of billing and payment, but the digitization and experience-driven changes face a few challenges. In order to deliver on this new demand, revenue cycle management must embrace new technologies, implement more touchless payment options, and consider the impact of an omnichannel experience—reaching customers on the platforms they prefer—while creating convenient, secure, and reliable interactions. To truly engage customers in the experience economy, revenue cycle management must implement a three-pronged approach—deliver an experience that’s: CONNECTED MOBILE CONVENIENT

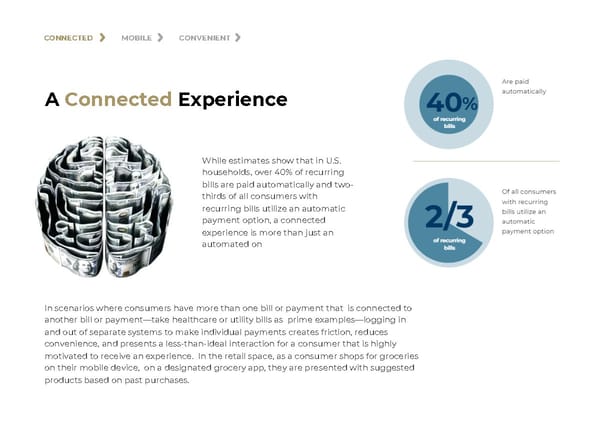

CONNECTED MOBILE CONVENIENT AConnectedExperience WhileestimatesshowthatinU.S. households, over 40%ofrecurring bills are paid automatically and two- thirds of all consumers with recurring bills utilize an automatic paymentoption,aconnected experienceismorethanjustan automatedon In scenarios where consumers have more than one bill or payment that is connected to another bill or payment—take healthcare or utility bills as prime examples—logging in and out of separate systems to make individual payments creates friction, reduces convenience, and presents a less-than-ideal interaction for a consumer that is highly motivated to receive an experience. In the retail space, as a consumer shops for groceries on their mobile device, on a designated grocery app, they are presented with suggested products based on past purchases.

The act of grocery shopping becomes an experience with it’s multi-faceted approach to shopping—it’s connected to historical purchases, it’s suggesting different paths to the consumer, and it’s all completed on the platform and device the consumer prefers. For billing and payment options, consumers expect a familiar, frictionless experience.

This is a modal window.

How to implement a connected payment experience for your customer: Allowyour ● If your business communicateswithyourcustomer(s)viatext, customersto offer text-based payment options. Include a direct link to see an up-to- makea paymentinatextmessage. ● Atcheckout,offermultiplepaymentoptionsthatappealtoyour dateaccounting customer.OptionsmightincludeApplePay,GoogleWallet,Ven mo,creditcardoptions,eCheck,and/orPayPal. of what's been ● If your business is likely to send multiple invoices or bill requests paid vs. what to your customer, allow your customertosee an up-to- dateaccounting is owed. of what’s been paid vs. what is owed. And when multiple syste msarebillingthesamecustomer,removethosesilosandthein evitable customerfriction by integrating each platform— providingthecustomerwithasingleviewofwhatisowed(rath er than multiple, disconnected invoices). ● Collect paymentattimeofservicewithcontactlesspayment, text-to-pay, and/or other digital collection options.

When you offer a connected payment experience, not only are consumers satisfied with a checkout and payment process that is grounded in experience, your backend processes are impacted as well. Front and back offices sync to stop revenue leakage, internal integration with other systems create a seamless, internal experience, and create a cohesive workflow from payment acceptance to processing, reconciliation, and insightful reporting. CONTINUE: A MOBILE EXPERIENCE

CONNECTED MOBILE CONVENIENT AMobileExperience To keep up with the experience economy, an anywhere experience is critical. Consumers expect to pay bills on the go, just as they order dinner for delivery, groceries for curbside pickup, and household staples for 2-day delivery. Convenience, speed, and ease-of-use are all wrapped up in a mobile experience.

Mobile-driven experiences are already mainstream. Over 80% of consumers say they want to make payments digitally on their phones or another online platform. 20% of consumers say they prefer to use an app to make payments. And what about consumers who prefer to make payments through the mail? Only 5%.

Correlation is high for consumers that already take part in some form of online finance experience—for consumers that use mobile banking, 64% also use some form of mobile billpay. Plus, 36% of online shoppers report that they prefer using an eWallet at checkout while 23% prefer using a credit card (debit cards come in much lower at only 12%). It’s clear that consumers want options to make payments on-the- go. In the experience economy, the expectation is that consumers can pay anytime, anywhere. Access on their mobile device (and even text messaging) creates an even more personalized, and preferred, checkout experience. Of course, security is a growing concern for anything digital, but like all other interactions, education and messaging are critical for consumer trust.

How to implement a mobile payment experience for your customer: ● Offer digital payment options online, including Apple Pay, Google Wallet, Venmo, credit card options, eCheck, and/or PayPal. ● Send payment reminder notifications before a bill or payment is due, at the time the payment is due, and after the payment is received, via email and/or text message. ● Communicate to your customers how your digital payment options are safe and secure, including any compliance and regulatory certifications. ● Provide convenient “at time of service” payment options so there is minimal revenue drag When you offer a mobile payment experience, you’re connecting with your customers on the channels and platforms they prefer. It increases speed-to-payment, delights your customer, and positions your organization for future innovation. CONTINUE: A CONVENIENT EXPERIENCE

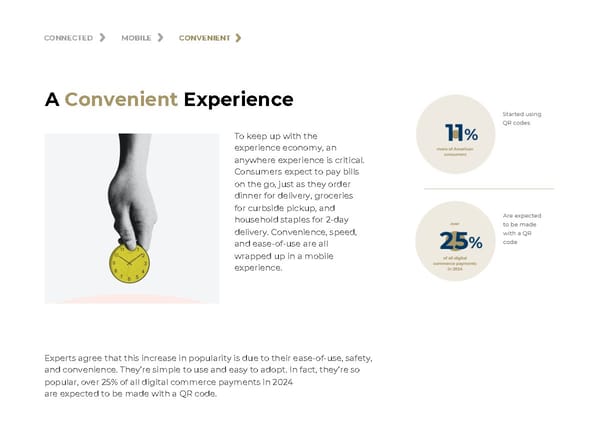

CONNECTED MOBILE CONVENIENT AConvenientExperience To keep up with the experience economy, an anywhere experience is critical. Consumers expect to pay bills on the go, just as they order dinner for delivery, groceries for curbside pickup, and household staples for 2-day delivery. Convenience, speed, and ease-of-use are all wrapped up in a mobile experience. Experts agree that this increase in popularity is due to their ease-of-use, safety, and convenience. They’re simple to use and easy to adopt. In fact, they’re so popular, over 25% of all digital commerce payments in 2024 are expected to be made with a QR code.

But offering a convenient experience often means more than just a direct link to payment via a QR code. Convenience also means meeting speed and frictionless expectations. For consumers, definitions can vary—when 50% of consumers hear “real time” in reference to a financial transaction, they expect an answer immediately (while 24% expect an answer within seconds). Of course this translates into more than communication and messaging—it extends into reduced friction at checkout. A speedy checkout process increases engagement and improves overall payment completion.

This is a modal window.

How to implement a convenient, frictionless payment experience for your customer: Reduce the ● Where possible, offer a direct link to payment via text message, steps to email, QR code, or mobile application notification. complete a bill ● Reduce the number of steps to complete a bill or payment transaction. or payment ● Offer touchless payment options as much as possible in-person. transaction ● Present familiar payment platforms at checkout, such as ApplePay, Google Wallet, PayPal, Venmo, and credit cards.

If your checkout process isn’t built around your consumer's number one priority, you’ll be left behind. When you offer a convenient payment experience, you increase payment collection, improve customer satisfaction, and pave the road ahead for satisfied customers. Providing convenience and a variety of payment channels isn’t just an added bonus anymore. It’s the baseline for all customer interactions, for every industry. If your checkout process isn’t built around your consumer’s number one priority, you’ll be left behind. With CORE, a secure PCI-compliant platform, your enterprise can modernize connected experiences through revenue automation, enable visibility into every step of revenue and payment activities, and incite immediacy by supporting anytime, anywhere payments.

With CORE, you can: ● Implement best-in-class, connected billing and payment experiences ● Reduce friction and delight consumers ● Control receivables and maximize collections ● Gain actionable insight into experiences and processes Ready for demo? LET’S CHAT